The UK Pension System Has Undergone More Changes Than You Think - Here's How

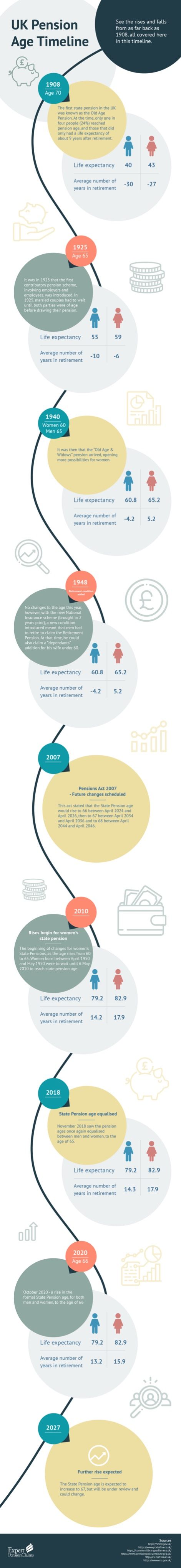

The UK pension system has undergone some dramatic changes over the years. Legislation has been written and rewritten time and time again, not just because we are living longer, but because the British people have fought for equality and a better quality of life for their final years after retirement.

Of course, advancements in the medical world have resulted in us living longer lives and a healthier, more active old age - but how far has the UK pension stayed in line with this?

Interestingly there have been enormous changes over the years, not just to the time expected in retirement, but to whether or not people will live long enough to draw their hard earned pension.

Pensions - the early days

Take the early 1900s - there was a pension known as the “Old Age Pension”, though less than a quarter of people lived long enough to see it. That means 76% of British people passed away before they reached pension age, usually a good decade or so before, too. It wasn’t until the late 1940s, when the life expectancy jumped from 40 something to 60 something, that the gap began to close up and a higher percentage of people got to enjoy some time in retirement.

Time for equality in UK pensions

As with many things historically, there was a major injustice when it came to gender. Men and women (although they prove to have slightly different life expectancies no matter what era we are in) suffered major inequalities when it came to pensions. Women could actually draw their pensions five years earlier than men in 1940, for example. But their life expectancy was, at the time, longer than their husbands’, meaning the men were much less likely to get their pension than women. This bizarre imbalance varied over the years and shifted closer to equality, but it wasn’t until 2018 that the pension age was fully equalised. At this point, men and women could both draw their pension at the age of 65.

What UK pensions look like now

Jump a few years forward to 2020 and the UK pension system, albeit still prone to twists and turns, appears to be better than it’s been historically. We are, of course, living longer and this number is rising alongside the rise of our healthcare technology. At the moment, the average man lives to 79.2, the average woman to almost 83, and both men and women are able to retire at the age of 66. As with legislation, there is always room for change, and change it will. Come 2027, we are likely to see further developments with retirement age. We will just have to wait and see what other changes will take place.

This article and the informative design within it comes from Expert Pension Claims, a leading UK company specialising in mis-sold pensions, SIPP claims and investment mis-selling. If you think you may have been mis-sold a pension or investment, get in touch with the team and see what you could be entitled to.