New service aims to slash £30bn owed to businesses in late payments

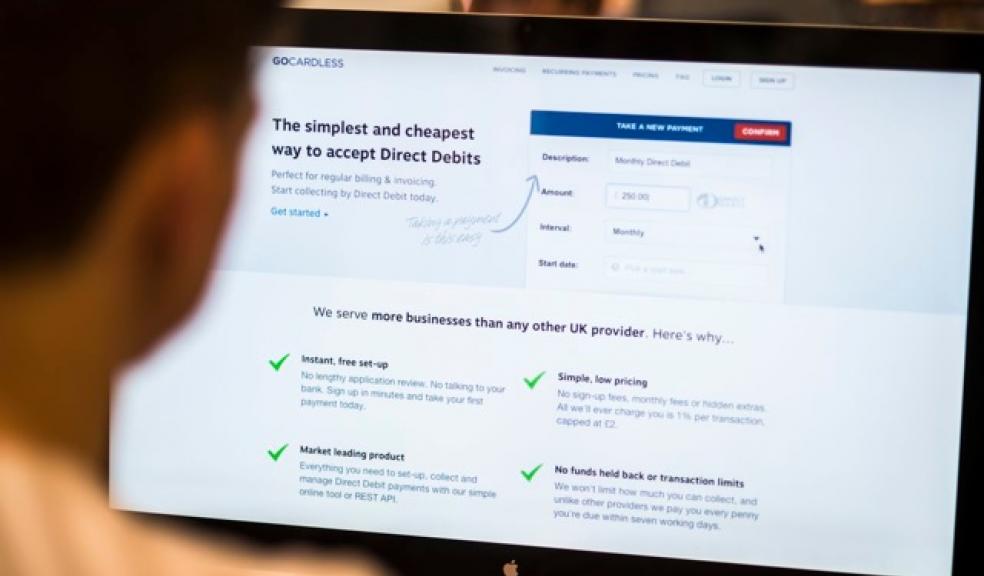

Online Direct Debit payments provider, GoCardless, today launched an online payment tool to enable greater numbers of small and medium sized enterprises (SMEs) across the UK to collect variable one-off and recurring payments by Direct Debit.

Traditionally only larger, more established businesses such as utilities providers and mobile operators have been able to access the infrastructure that underpins the Direct Debit system. As a result, SMEs were excluded from accessing the system by the banks, and forced to cede control of when they are paid to unreliable customers.

Paul Bugge, owner of The Beacon Advertiser in Plymouth, says, “GoCardless enables us to control when we are paid, instead of always chasing late payments. As a result, we are saving 15 to 20 hours every month managing payments.

Since switching to the system, the success rate on payments has increased to 100 per cent and we can forecast our cash flow down to the penny. GoCardless has allowed us to put poor payers behind us and focus on the future.”

GoCardless is steadily transforming the payments space by allowing any business or individual to tap into the Direct Debit network and has been making such payments available to SMEssince November 2011.

The newly updated service enables SMEs to take full control of variable regular payments for the first time. Now businesses can adjust the billed amount every month. Variable payment plans are the most common way of billing for a wide range of businesses, including those which rely on regular invoices such as accountancy firms, or subscription based businesses including day nurseries or gyms.

Late payment is a major issue for SMEs, with 59 per cent regularly struggling to get paid on time. Estimates suggest such businesses waste 14 days a year on average chasing payment, and are collectively owed £30bn in overdue amounts. With GoCardless, businesses can sign up and start collecting in seconds, helping to cut delays and simplifying payment collection.

Businesses sign up online and can start taking payments immediately. Unlike traditional Direct Debit providers, GoCardless does not charge up-front, or have any monthly or hidden fees. Instead, a simple, low transaction fee of 1 per cent, capped at £2, is deducted from each payment, less than a third of the amount PayPal and others charge.

Commenting on the launch, founder Matt Robinson says: “Direct Debit is the most reliable way to take payments but for a long time small and medium sized businesses have been excluded from the system. GoCardless gives them instant, easy access to the payment method which larger competitors have been using for years. With this new development to our service, businesses can always rely on prompt payment even if customers’ monthly bills vary.”